Predictions for first interest rate rise moves again

Experts advise cash savers to invest their money elsewhere…

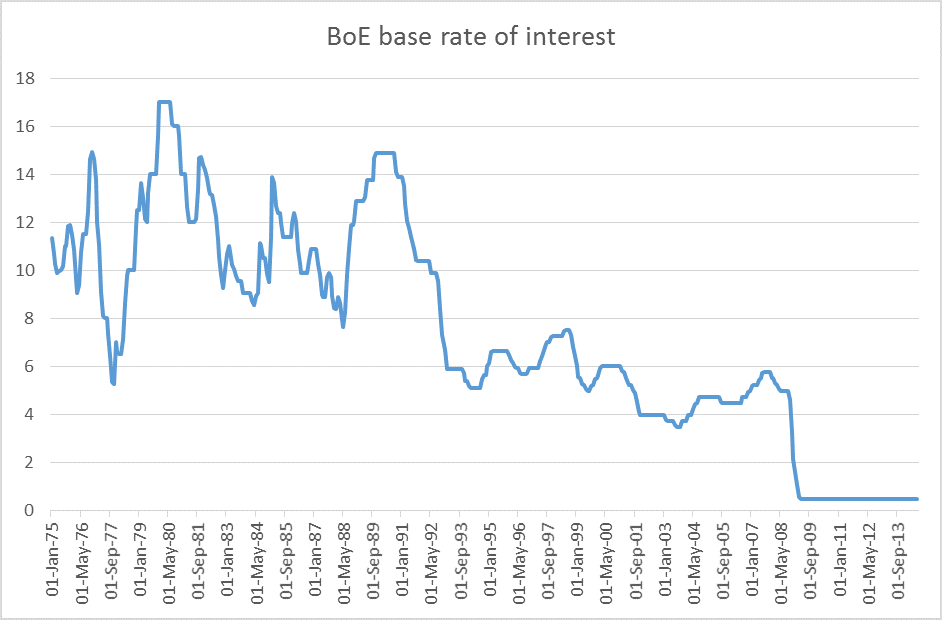

With the six-year anniversary of historically low UK base interest rates standing firm at 0.5%, things are looking rosier for the economy, but savers and investors are clearly losing out.

The Bank of England kept the base rate (the “price” of money) at historic lows of 0.5% this year

A recent article posted on FE Trustnet’s website quoted Alex Doctor-Huran, a savings and investment expert at BlackRock:

“Cash makes people feel safe and so we hold too much of it. If you are saving with income generation in mind, you need to own less cash when rates are this low and inflation, even at 0.5 per cent, is eating away at your money in the long-term.”

“People are aware they hold too much cash. As the end of the tax year approaches, savers should think about using their ISA allowance to take steps out of cash and seek more effective ways in which their savings can provide an income to make their money work harder for them.”

Therefore, it’s no shock that financial gurus are recommending that people with disposable cash should really be looking elsewhere to maximise returns.

To add fuel to the fire, there is always varied speculation on when and if interest rates will rise or even fall for that matter.

At the back end of 2014, the steep decline in the rate of inflation at 1%, lower than the 2% target, together with the dilution of economic recovery, means experts now predict a potential rate rise may not appear until August 2016.

The Telegraph reports that further years of low rates could be on the horizon influenced by the true picture of Britain’s economic recovery, state and consumer debts and the demise of an economic boom underpinned by baby boomers now in retirement.

Global forces are also creating deflationary effects, with the Eurozone heading into deflation, the oil prices tumbling 50% since Summer 2014 and Japan’s policy on devaluing its currency, which could impact world markets.

At a record low 0.5% since March 2009, markets predict it is likely this figure will remain until July or August 2016 compared to a rate rise in March 2015, which was originally forecast the beginning of the New Year.

The report from FE Trustnet can be read here.

Click here for the Telegraph’s analysis.